How to Choose the Best Insurance for Your Car?

Choosing the best insurance for your car can seem confusing. With so many options, it’s important to understand what works best for your needs. Car insurance protects you from financial loss if your car gets damaged, stolen, or involved in an accident. By selecting the right plan, you can save money and stay protected in case something goes wrong.

Types of Car Insurance

Understanding the types of car insurance is the first step to finding the right coverage. Here are the most common options:

- Liability Insurance: The most basic type, often required by law. It covers the cost of injuries and damages to other people and their property if you are at fault in an accident. However, it doesn’t cover damage to your own car.

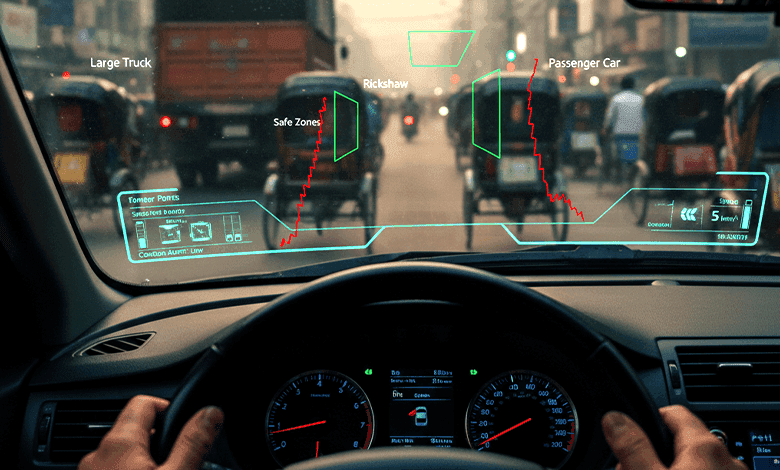

- Comprehensive Insurance: Provides broader protection. Covers not only accidents but also theft, fire, vandalism, and natural disasters.

- Collision Insurance: Pays for repairs to your car if it is damaged in a collision with another vehicle or object, regardless of fault.

- Personal Injury Protection (PIP): Covers medical expenses for you and your passengers after an accident, regardless of fault. Some policies also include lost wages and rehabilitation costs.

- Uninsured/Underinsured Motorist Coverage: Protects you if you get into an accident with someone who has no insurance or insufficient coverage.

How to Choose the Best Insurance for Your Car

Determine Your Coverage Needs

Before picking a policy, assess what type of coverage you need. Are you comfortable with basic protection like liability insurance, or do you prefer the peace of mind of comprehensive coverage?

Your decision should be based on factors like how often you drive, the age of your car, and where you live. For example, if you live in an area prone to theft or extreme weather, comprehensive insurance is a better option.

Also, check local legal requirements since most regions have mandatory minimum coverage. Ensure your policy complies with these laws to avoid penalties.

Compare Insurance Providers

Not all insurance companies offer the same services. Compare multiple providers to find the best deal. Look into their customer service reputation, claims process, and coverage options.

Check for Discounts

Many companies offer discounts that can lower your premium. You may qualify for discounts based on:

- Safe driving history

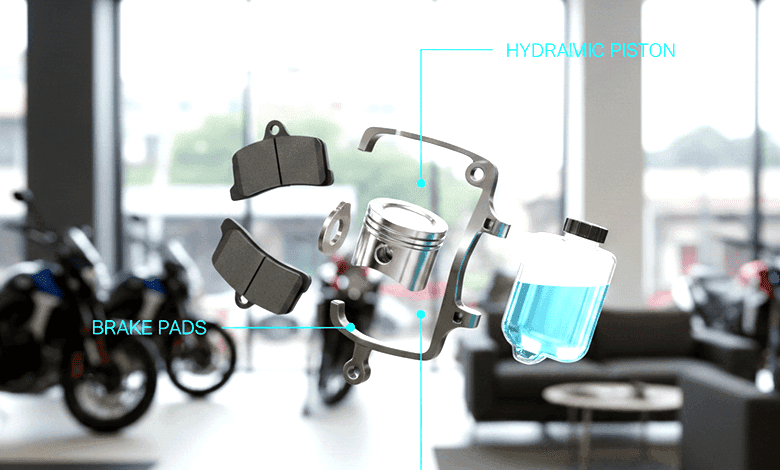

- Safety features in your vehicle

- Status as a student or senior

- Bundling car and home insurance

- Low mileage or telematics-based safe driving programs

Review the Deductible and Premium

Your plan will include a deductible (what you pay out of pocket before insurance applies) and a premium (monthly or yearly payment).

- A higher deductible lowers your premium but increases costs when you make a claim.

- A lower deductible raises your premium but reduces out-of-pocket costs after an accident.

Choose a balance based on your driving habits, financial situation, and risk tolerance.

Understand the Terms and Conditions

Read the terms and conditions carefully. Understand what damages are covered, exclusions, and limitations.

Some policies may not cover certain natural disasters or exclude specific drivers. Check for extra features like roadside assistance, rental car coverage, or towing services.

Conclusion

Choosing the best car insurance involves understanding your needs, comparing providers, and reviewing terms. By evaluating different coverage types, checking for discounts, and selecting a fair deductible and premium, you can ensure your car and finances are well-protected.