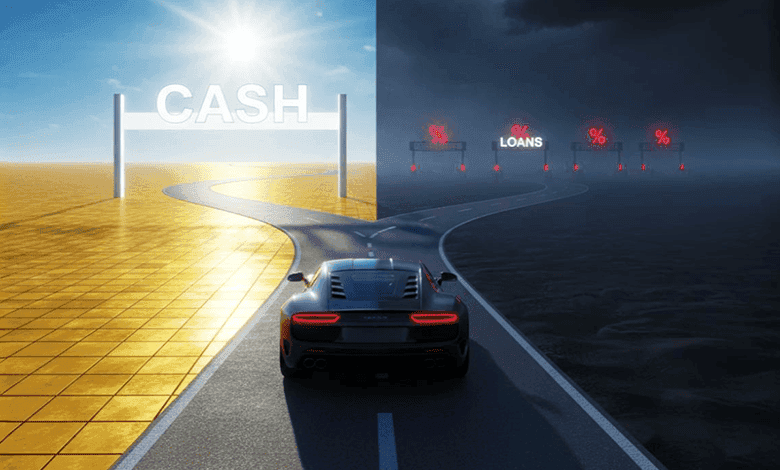

Vehicle Loan or Full Cash? Which Buying Option Saves You More in Bangladesh

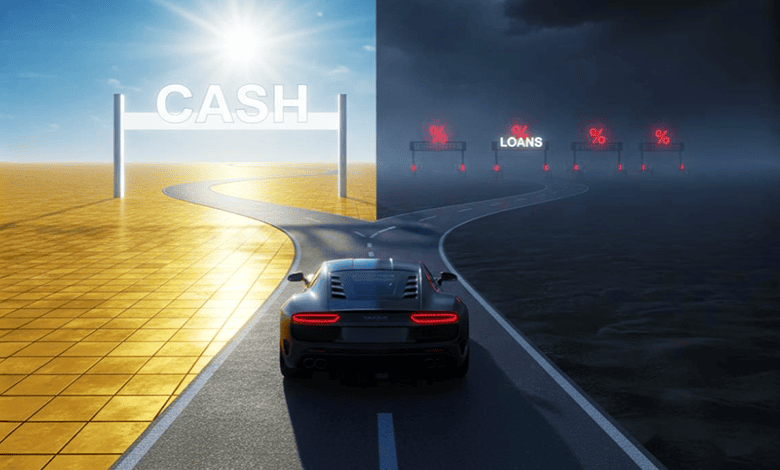

Buying a vehicle in Bangladesh is a big investment. Before making such a big decision, many people consider whether to finance the vehicle with a loan from a financial institution or pay cash. According to your financial situation, consider whether full cash or a loan is more economical. For example, buying in full cash will save you from paying interest, while buying on a vehicle loan will save you from paying a lot of money at once.

You must consider which option is better by keeping in mind the vehicle's market price, interest rate, down payment, incidental costs, terms and policies, your income and financial plan, etc. This blog has discussed in detail which method is more economical when buying a vehicle, a loan, or full cash.

Which method is more economical when buying a vehicle - a loan or full cash?

If you buy a vehicle in full cash, there is no debt pressure, and you get immediate ownership. However, in this case, a large amount is spent, savings are reduced, and the opportunity to invest elsewhere is reduced. On the other hand, if you buy a vehicle on loan from a financial institution, you have liquidity in hand, and you get the benefit of paying in installments for 5 years or more. You may invest the remaining money elsewhere. However, when buying a vehicle with a loan, the interest rate must be taken into consideration.

1. Buying a vehicle in full cash

If you buy a vehicle for full cash payment, you can get ownership of the vehicle along with legal documents without any hassle. The most important thing is that you do not have to bear the burden of interest.

Pros

- You have to bear the original price of the vehicle and ancillary costs; there are no additional charges.

- Immediate ownership, i.e., registration, insurance, etc., is available.

- Monthly EMI, loan processing fees, and terms and conditions are not taken into account.

- A vehicle is a valuable asset.

Cons

- Large amounts of money have to be invested.

- Savings decrease.

- Urgent needs or investment opportunities decrease.

2. Buying a vehicle with a loan from a financial institution

Different financial institutions in Bangladesh offer vehicle loans. Banks offer loans of up to 70% depending on the price of the vehicle and your financial situation. The customer has to make at least a 20% down payment. The loan installment period can be from 1-7 years. The interest rate on this loan is usually between 12-16%.

Pros

- By making a certain amount of down payment, the remaining money can be paid in installments.

- Since you do not have to pay a huge amount of money, you have liquidity in hand.

- You will get the opportunity to invest your savings elsewhere.

Cons

- Additional interest costs will have to be incurred. For example, an average of 30-50 thousand taka may have to be paid in installments.

- You will have to bear processing fees, bank insurance fees, CB report fees, etc., until the installment payment is complete.

- If you do not pay the installments on time, additional interest will be added. If you miss several installment payments, the company can seize the vehicle.

3. Loan or cash - which one will be more affordable for you?

Buying a vehicle is not the only expense. You also have to keep in mind maintenance costs, fuel costs, various taxes, insurance, driver costs, etc. So if you buy on loan, along with installments, you will have to bear these costs. If you have a stable, healthy income but do not have sufficient savings, or if you have more income from other investments, buy a vehicle on loan. Then a vehicle loan will be affordable for you. If you have sufficient savings, buy a vehicle completely in cash. Because the interest rate on vehicle loans in Bangladesh is high.

Final Thought

Considering the public transport system and traffic situation in Bangladesh, buying a vehicle is no longer a luxury but has become a part of daily life. Along with the socio-economic development of the country, many people are becoming interested in buying a vehicle for family needs. However, due to the high price of vehicles in Bangladesh, which option is more affordable in the long run, loan or cash cost, must be considered.

Frequently Asked Questions

1. Which is more economical to buy a vehicle in the context of Bangladesh, a loan or cash?

If you have a stable, healthy income but do not have sufficient savings, or if you have more income from other investments, buy a vehicle on loan. If you have sufficient savings, buy a vehicle in full cash.

2. What is the interest rate of a loan in financial institutions in Bangladesh?

The interest rate of a vehicle loan in Bangladesh is slightly higher. The interest rate of a loan is usually between 12-16%.

3. In which cases is it better to take a loan?

If you have money to invest, there is a possibility of getting sufficient returns. And if you have a good permanent source of income.

4. How much is the down payment for a vehicle loan?

Generally, a down payment of at least 20% of the original price is required.

5. What are the advantages of buying a vehicle in full cash?

If you buy a vehicle for full cash payment, you can get ownership of the vehicle along with legal documents without any hassle. The most important thing is not to worry about interest.