All About Bike Loans

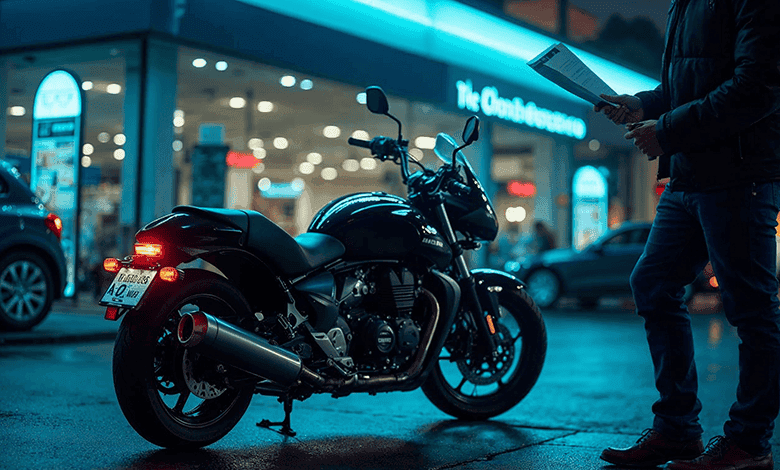

We are all familiar with the severe traffic congestion in the country. As a result, motorcycles are becoming increasingly essential for comfortable and fast commuting in busy city life.

From reaching workplaces quickly to traveling anywhere on time, motorcycles provide great convenience. However, many people who want to buy a motorcycle face financial constraints. To help them, banks are now offering bike loans.

Private banks in Bangladesh traditionally provided loans for purchasing cars, but now, due to growing demand, several have introduced motorcycle loan schemes. With these loan offers, owning a new motorcycle has become much easier.

Currently, banks such as The City Bank (city bank bike loan), Eastern Bank, Uttara Bank, HSBC, Prime Bank, and BRAC Bank (brac bank bike loan) are providing special motorcycle loan services. These bike loans offer attractive opportunities to interested customers, with loan amounts up to 5 lakh BDT. However, certain conditions must be met to avail these loans.

Bike Loan Partnerships

Nowadays, banks are directly partnering with brands for motorcycle loan schemes. For example, City Bank has partnered with Suzuki. City Bank AMEX credit cardholders can repay their loans over 34 months if they purchase a Suzuki bike.

Similarly, BRAC Bank provides loans for Yamaha motorcycles. The advantage of installment-based motorcycle purchases is that bikers can own premium bikes at an affordable monthly cost.

In Bangladesh, Yamaha, Bajaj, TVS, Hero, Runner, and other brands are offering installment purchase facilities, making it easier for bikers to buy their preferred bikes quickly.

Advantages and Disadvantages of Buying Bikes on Installments

| Advantages | Disadvantages |

| Ability to buy modern bikes with advanced features with less upfront money | Higher overall cost due to interest |

| Affordable with no large immediate expense | No compensation in case of bike damage |

| Possibility to own expensive bikes within a short time | Unexpected damages must be borne by the buyer |

Hero Motorcycle Loan Installment System

Hero motorcycles in Bangladesh can be purchased with just a 20,000 BDT down payment. Installment options range from 6 to 18 months for new updated Hero models.

The biggest advantage is the low interest rate—only 1% interest is charged on all Hero motorcycles sold on installments. The Hero website also offers an EMI calculator to calculate installments, registration fees, and total costs.

Required documents include monthly utility bills, guarantor details, NID/passport, and bank statements for the last 3–6 months. Business owners must provide trade licenses, while salaried employees must show salary slips and certificates. Payments can be made through cash, bank deposits, Rocket, or bKash.

Documents Required for Bike Loan Applications

- Copy of National ID

- E-TIN and business card

- Office ID copy

- Salary certificate or income statement

- Utility bill copies

- Quotation of the bike price

- Bank statement

- Security checks from any bank

- Trade license (for businesses)

- House/flat rental documents

- Application form

- Updated trade license

- TIN certificate

- Net worth statement

- VAT certificate (if required)

- Permission documents depending on business

- Customer and guarantor’s NID copy

- CIB undertaking

- Financial statement

The Reason for the Demand for Bike Loans in Bangladesh

Motorcycles are no longer just a hobby for young people—they are now considered an essential means of daily transport. In cities like Dhaka, where traffic jams delay commutes to offices, schools, and universities, bikes have become a necessity.

Many cannot afford bikes outright, making loans a great relief. Food delivery services (like Foodpanda), ride-sharing (Pathao, Uber), and parcel delivery businesses rely heavily on motorcycles. Bikes are essential to reach destinations on time in a busy city, and increasing workplace needs have further boosted demand.

This is why most banks are offering bike loans now. We expect that installment-based bike purchases will be made even more accessible by government support in the future.

FAQs about Bike Loans in Bangladesh

1. Which banks offer bike loans in Bangladesh?

Currently, The City Bank, Eastern Bank, Uttara Bank, HSBC, Prime Bank, and BRAC Bank have introduced motorcycle loan services, offering great opportunities for buyers.

2. What documents are required for a bike loan?

Applicants must provide utility bills, guarantor details, NID/passport, and bank statements for the last 3–6 months. Business owners need a trade license, and salaried employees must provide salary slips and certificates. Payments can be made through cash, bank deposits, Rocket, or bKash.

3. What is the interest rate for Hero motorcycle loans?

Only 1% interest is charged for all Hero motorcycles bought on installments.

4. What are the disadvantages of bike loans?

- Higher price due to interest

- No damage compensation

- Unexpected repair costs must be borne by the buyer

5. Which brand bikes does BRAC Bank provide loans for?

BRAC Bank offers loans specifically for Yamaha motorcycles.