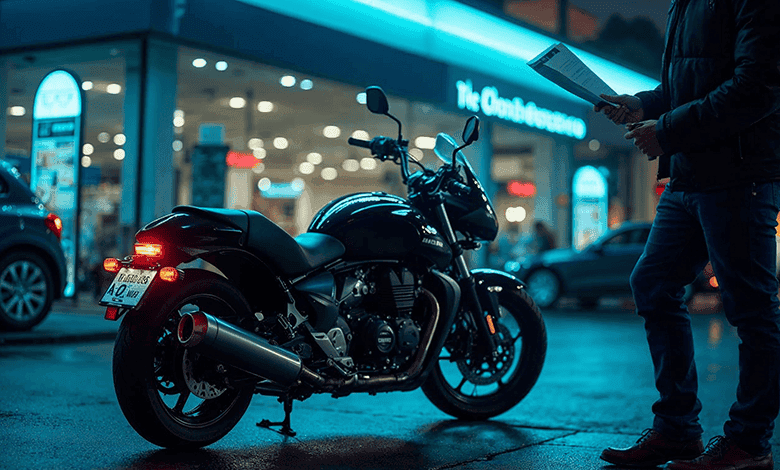

Buying a Motorcycle in Installments? Here Are Some Useful Tips

A dream motorcycle is not always within everyone’s reach. Due to life struggles and rising living costs, many dreams remain unfulfilled during youth. One way to make this easier is through installment purchase options. Almost every motorcycle showroom in Bangladesh, both local and international, now offers installment facilities. Today, we’ll discuss the essential things you need to know before buying a motorcycle on installments.

Research the Motorcycle Companies

Before buying on installments, you should research which companies offer installment options and under what terms. In Bangladesh, companies like Yamaha, Bajaj, TVS, Hero, Runner, and Walton provide installment facilities. The terms may vary depending on the brand and model, but some aspects remain similar across the board.

Most companies require 0–50% of the motorcycle price as a down payment, with the rest payable in monthly installments over a chosen period. While this method reduces upfront spending, the total cost ends up being higher due to added interest.

Types of Installment Options

There are mainly three types of motorcycle installment systems: direct company installment, bank loans, and credit card EMI (Equated Monthly Installments).

Direct Installment: Offered by dealers or companies for specific models. You can buy from verified showrooms or brand dealers with easy payment options.

Bank Loan: You may apply through a bank or via dealer support. Large showrooms often have partner banks to guide you through the process. To qualify, you must meet certain criteria and provide required documents.

Eligible applicants for bank loans include:

- Salaried employees: Must have salary credited to a bank account and provide a transaction statement. Minimum monthly salary is usually 15,000–20,000 BDT.

- Business owners: Must have a valid trade license and maintain monthly transactions of at least 5–6 lakh BDT in a business account.

- Property owners: Can qualify if they have verifiable property income deposited into a bank account.

EMI via Credit Card: Requires an active credit card with installment facility and sufficient limit.

Required Documents for Installment Purchase

Address Proof

Provide a valid address for contact purposes. Proof may include utility bills (electricity, phone, water, or gas) from the past three months only.

Identity Proof

National ID card or passport is most commonly required. Driving license or trade license may work in some cases, but NID is generally mandatory.

Bank Statement

Bring 3–6 months of recent bank statements or proof of an active account. In some cases, bank solvency certificates are accepted.

Income Proof

Business owners must provide an updated trade license. Salaried employees need at least three months’ salary slips or bank statements, and in some cases, a letter signed by their department head.

Guarantor Documents

If you don’t qualify alone, a guarantor is required. Documents include a passport photo, NID copy, post-dated cheques, and an affidavit on 200 BDT stamp paper. The motorcycle company usually provides affidavit formats.

Driving License

Whether you buy with cash or installments, you must apply for a driving license first. Selling motorcycles without ensuring a license is illegal in Bangladesh.

Pros and Cons of Buying on Installments

The main advantage is affordability — you can own your dream bike without paying the full price upfront. This allows many to buy the latest models with advanced features. Instead of waiting to save up, you can pay gradually.

However, there are disadvantages too. Interest makes the total price higher than the market value. Until the installments are cleared, you don’t have full peace of mind. If the bike is damaged or stolen, you must still pay monthly installments, along with maintenance or filing a police report for theft.

Conclusion

Consider both advantages and disadvantages before deciding. Think about your lifestyle and financial stability before opting for installments. Don’t forget to check the registration process after purchase. Doing this yourself can save you from relying on middlemen. Hopefully, this guide will make your decision easier and help you avoid extra hassles. Congratulations on your new motorcycle purchase!

Frequently Asked Questions

How do I pay installments?

Payments can be made via MICR or non-MICR security cheques at online branches. Cash payments via bKash, Rocket, or direct deposit are also accepted.

What is the minimum down payment?

It varies by brand and policy. International brands usually require 15–30% down payment, while local brands like Walton, Runner, or Roadmaster sometimes offer 0% down payment options.

Which banks in Bangladesh offer the best bike loans?

Some of the best banks for bike loans include:

- Eastern Bank Limited (EBL)

- Uttara Bank

- The City Bank

- Prime Bank

- BRAC Bank

What does EMI mean?

EMI stands for Equated Monthly Installment — fixed monthly payments made towards a loan.

What is the minimum age requirement for bike loans?

You must be at least 21 years old (based on NID). The maximum age at loan completion is 60 years.