Rules and Fees for Motorcycle Insurance

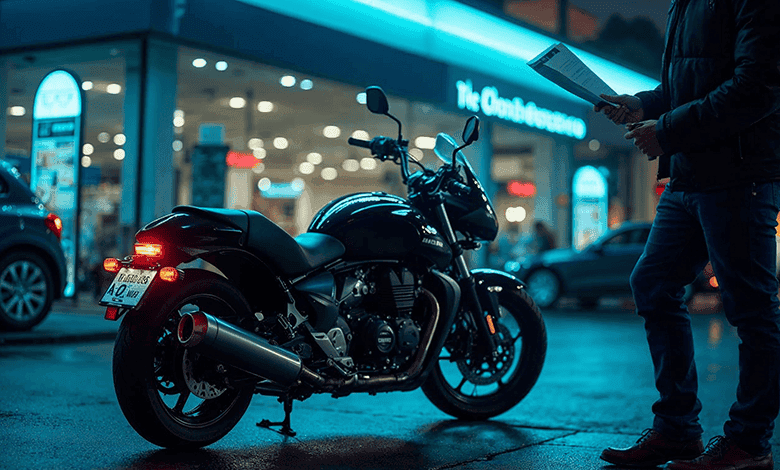

Motorcycle accidents are a very common issue on open roads in Bangladesh. To get financial protection against damages caused by accidents, having motorcycle insurance is essential. With insurance, your vehicle has a secured future — in case of accidents or damage, compensation will be provided. It is also important to carry documents while riding.

If your motorcycle is already insured, you won’t have to bear expenses if it gets damaged in an accident. Information about motorcycle insurance in Bangladesh is often difficult to find, but don’t worry — if you don’t know how to get motorcycle insurance, this article is for you.

Insurance companies in Bangladesh offer different plans according to people’s needs. If you want to buy an insurance policy for your two-wheeler, you should compare various policies and choose the one that best suits your requirements.

Although motorcycle insurance coverage has not been mandatory in Bangladesh since 2020, having one is still very useful to avoid losses from accidents. In this article, I will give you a complete overview of the motorcycle insurance process.

What is a Motorcycle Insurance Policy?

A motorcycle insurance policy is essentially a contract between an insurance company and an individual, where the insurer agrees to provide compensation for damages in case of accidents, natural disasters, or theft.

Generally, a motorcycle insurance plan provides protection against accidents that may harm the rider, pedestrians, or third parties, depending on the type of policy you purchase. To buy the most affordable two-wheeler insurance policy with adequate coverage, it is essential to compare different plans.

Basically, motorcycle insurance policies are designed to provide financial coverage against various unfortunate events and accidents. Since accidents may damage the insured two-wheeler, injure the rider or pedestrians, or harm third-party property, insurance companies design their policies accordingly.

Benefits of Motorcycle Insurance

A proper bike insurance policy gives you many benefits, such as:

Financial relief: If your bike is damaged or stolen, you don’t need to worry about repair or replacement costs. The insurance company will provide financial support based on the damages.

Legal protection: Although having bike insurance is no longer mandatory in Bangladesh (as per the Road Transport Act 2018, effective from 2020), carrying a copy of your insurance policy while riding helps you avoid legal complications.

Personal accident coverage: If insured, you will receive compensation in case of permanent disability. In the event of death, your family will receive the insured amount from the company.

No Claim Bonus: You can also enjoy benefits like a no-claim bonus if no claims are made during the policy period.

Documents Required for Motorcycle Insurance

To apply for motorcycle insurance in Bangladesh, you need:

- Bike documents

- Two recent passport-sized photographs

- Photocopy of National ID

- Bike’s Bluebook

- Driving license

- Purchase receipt of the motorcycle

How to Get Motorcycle Insurance

There are many insurance companies in Bangladesh that offer different facilities for two-wheeler insurance. First, review their policies to understand the coverage. Then, select a company and purchase the insurance plan that suits you best.

If you prefer to visit an insurance office, bring the required documents with you. You’ll be given a form to provide your bike’s details. After submitting the form with documents as instructed, your insurance will be activated within three working days.

If you want to avoid the hassle of visiting an office, you can also get insurance online from home.

Online Motorcycle Insurance Process

Getting online motorcycle insurance in Bangladesh is very simple. You can apply online by filling out a form and submitting it to the insurance company. A representative will inspect your bike to confirm its condition.

If everything is fine, they will issue your policy and send it via courier within 24 hours. In case of an accident or theft, the insurance company will help you repair or replace your bike without difficulty.

Follow these steps to complete the online insurance process:

- Visit the official website of the insurance provider.

- Select the Online Motorcycle Insurance option from the homepage.

- Fill in the online form with details about your bike and your personal information, including address and contact number.

- Upload a scanned copy of your passport or ID card.

- Upload a scanned copy of your driving license or learner’s permit in JPEG or PDF format.

- Upload a scanned copy of your bike’s registration certificate. For vehicles over three years old (or registered at least five years before purchase), additional certification from government authorities may be required.

- Select a payment method such as bKash, Nagad, Rocket, debit card, credit card, or bank account.

- You will receive a confirmation message and a copy of your policy in your email.

- Within three working days, you will receive the printed insurance copy.

If your bike is damaged in an accident on the road or in a public place, you can file a claim within 30 days under your insurance policy.

Motorcycle Insurance Fees in 2022

In Bangladesh, motorcycle insurance fees depend on the type of bike. There are two types of coverage: Third-party liability and Comprehensive.

Third-party liability insurance covers damages to other people or property while riding your bike, including vehicles, people, and assets. Comprehensive insurance covers your bike’s damage, injuries, or death of passengers while riding.

The insurance fee is set by the national insurance authority and depends on factors such as:

Age of the bike: The newer the bike, the cheaper the insurance.

Engine size: Smaller engines have higher premiums compared to larger ones. Currently, registration fees for motorcycles up to 100cc are 2000 BDT (previously 4200 BDT), and for motorcycles above 100cc, it is 3000 BDT (previously 5600 BDT).

Registration duration: The longer your bike has been registered without claims, the lower your annual premium may become. In some cases, after three years without accidents, premiums may be waived.

Value of the bike: Premium depends on the model. Newer models have higher premiums compared to older ones.

If you own multiple bikes, you must buy separate policies for each, but combined policies may be more cost-effective. The minimum insurance amount is set at 100,000 BDT for one year and 500,000 BDT for three years.

What to Do if Motorcycle Insurance is Cancelled

If your motorcycle insurance is canceled, you may reapply after one month, although the time may vary depending on circumstances.

Normally, bike insurance is not canceled due to damages or accidents. It is only canceled if you fail to pay premiums or if your credit card is blocked.

If your insurance is canceled, you must immediately contact your insurance company and provide the following documents:

- A copy of your license and vehicle registration

- Your policy number or bulk-rated policy number (found on the back of the policy)

- A photocopy of your passport or other official identification document

If your insurance was suspended due to unpaid premiums, you must settle all dues before reinstating your license. If no outstanding premiums or legal issues exist, your license may be reinstated without any additional payments.