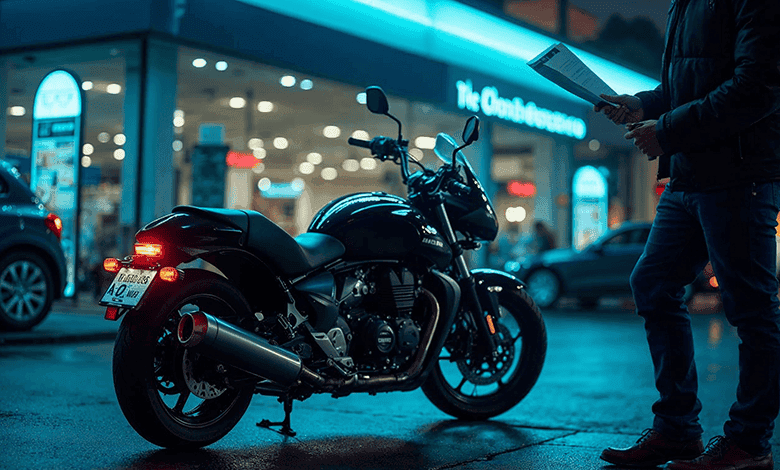

Online Motorcycle Insurance – How and Why to Do It

Online Motorcycle Insurance in Bangladesh

Bike insurance is a product that allows a rider to transfer legal liability by paying a certain amount of money called a “premium.” Motor insurance is mandatory in Bangladesh. Every motorcycle rider must have insurance from an authorized company.

Motorcycle insurance is a policy that provides coverage against accidents, theft, and natural disasters that may cause damage to your bike. Bike insurance is a unique solution to recover financially from damages caused by accidents. However, due to a lack of proper knowledge of the rules, many customers face harassment from insurance companies.

How to Buy Bike Insurance Online in Bangladesh

In Bangladesh, several companies have made it easy to buy bike insurance online. Riders can now purchase insurance policies in just 3–5 minutes using a mobile device or computer online.

The “Act liability insurance policy” is usually bought by riders because it is mandatory and affordable. This policy costs only around 250–300 BDT. The actual cost depends on engine capacity and bike specifications.

Here are 5 steps to buy bike insurance online in Bangladesh:

Types of Motorcycle Insurance Plans in Bangladesh

In Bangladesh, there are mainly two types of insurance plans:

Third-party motorcycle insurance: This protects against legal liability to third parties (property or people) in case of an accident. It also covers death or injury of third parties.

Comprehensive motorcycle insurance: This covers third-party liabilities as well as damages from accidents, theft, and natural disasters.

Price Chart for Motorcycle Insurance