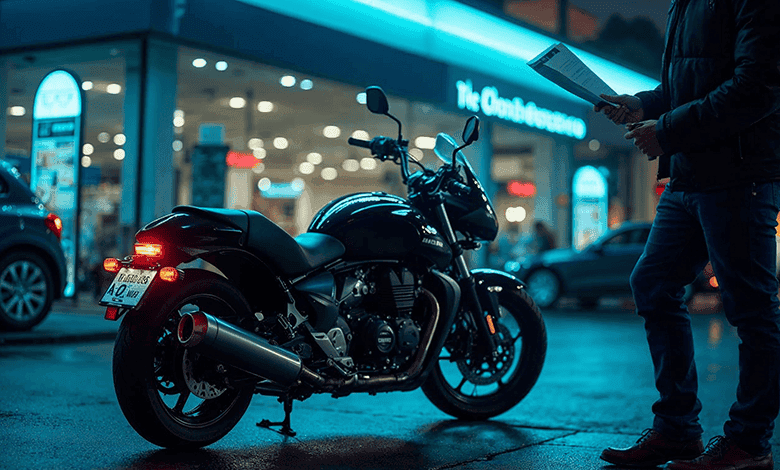

Motorcycle Insurance Not Required Under the New Law

Many people want to know whether motorcycle insurance is currently required in Bangladesh. In today’s article, we will explain whether insurance is mandatory under the new law, and whether there is any legal risk if you don’t have it.

If you own a motorcycle, having a license as well as insurance is very important. An insurance policy will protect your motorcycle against accidents, theft, fire, and other risks.

If your bike is stolen or damaged, the insurance policy will help you claim compensation for the loss of your motorcycle or damages caused by it. You can buy the policy online, through an insurance company, or directly from the issuer. Let’s find out whether motorcycle insurance is required or not.

Is Motorcycle Insurance Required?

Currently, motorcycle insurance is not mandatory. At one time, motorcycle insurance was compulsory in Bangladesh, but the Road Transport Act 2018, which came into effect in 2020, made insurance optional for bike owners. The Bangladesh Road Transport Authority instructed the police not to file cases against vehicle owners for not having third-party insurance.

According to Section 109 of the Motor Vehicles Ordinance 1983, third-party insurance was compulsory, and violating it was a punishable offense. But under the current Road Transport Act 2018, third-party insurance is not mandatory, and there is no penalty for not having it. Therefore, no owner or vehicle can be charged for not having third-party insurance under this law, even though the act was passed two years ago, it is still rarely discussed.

The act also abolished compulsory third-party insurance and introduced a new provision where compensation for injured passengers, drivers, or third parties will be provided from a special fund. This measure encourages other sectors to create self-insurance pools.

Why is Motorcycle Insurance Important?

If you do not have bike insurance, you may be held personally responsible for any damages or injuries caused by your motorcycle.

There are two main types of motorcycle insurance: Basic and Comprehensive.

The primary difference between them is the extent of coverage. Basic insurance usually covers only replacement costs of your bike, but not claims such as theft.

Comprehensive bike insurance includes all these costs, and it also provides legal defense if you are involved in an accident while riding.

Physical Coverage

Physical coverage includes expenses for repairing or replacing damaged bike parts as well as accessories like helmets, locks, and clothing (if securely locked at night). This type of policy covers theft and replacement of damaged bike parts, but not damages caused by overspeeding, running stop signs, or riding without a helmet. It also covers damages caused by driving without a license, not wearing approved safety gear (such as eye protection), or riding on the wrong side of the road.

Non-Physical Coverage

Non-physical coverage provides liability protection for bodily injury and property damage caused while riding on public roads, trails, or pavements. This policy helps cover repair or replacement costs for your bike, as well as legal fees if you are arrested while riding. It includes coverage for damaged rims, frames, broken windshields, cracked bumpers, and side panels — even if caused by another party in an accident involving multiple vehicles.

Motorcycle Insurance Law 2022

Motor vehicle insurance requirements in Bangladesh are governed by law. According to the Road Transport Act 2018:

Subsection 1 states that a motor vehicle owner or company may choose to insure passengers’ lives and property for any motor vehicle owned for transportation.

Subsection 2 requires that vehicle owners insure their vehicles according to rules so that accidents or damages are covered, and the insurer receives appropriate compensation.

Subsection 3 states that if a motor vehicle is involved in an accident or damaged, it cannot claim compensation from the financial assistance fund established under Section 53.

The Motor Vehicle Tax Act 1932 prescribes that many vehicles must have compulsory insurance when driven on public roads or highways. It also sets minimum insurance requirements for different vehicle types.

The Motor Vehicle Tax Rules 1966 impose additional charges on insured individuals regarding vehicles and their operation on government roads and highways.

Failure to comply with these rules will result in fines and penalties for not paying premiums within the specified time, as determined under the Bengal Motor Vehicle Tax Regulations.

Motorcycle Riding Rules in Bangladesh

In our country, motorcycles are both essential and very popular among the general public. However, before riding, one must be aware of the rules.

The rules for riding a motorcycle are fairly simple:

- The minimum age to ride a motorcycle in Bangladesh is 18 years. A licensed and experienced rider must always be present on the front seat, and you must hold all required licenses before riding.

- Riders must wear helmets while riding. According to the law, helmets are mandatory, and both riders and passengers must ensure they wear them.

- The maximum speed on highways is 80 km/h for licensed riders and 50 km/h for learners. This applies only to motorcycles registered under the BRTA.

- Motorcycles can be ridden on both urban and rural roads, but on highways they must not exceed 50 km/h, and on other roads not more than 10 km/h over the limit.

- Riders must have insurance coverage for their vehicles. This ensures protection if something goes wrong while riding.

- When riding on main roads, traffic rules and signals must always be followed, otherwise fines may apply.

Conclusion

In conclusion, according to the Road Transport Act 2018, passed in November 2020, motorcycle insurance is not mandatory. Therefore, if you don’t have insurance, no case will be filed against you. However, due to a lack of awareness of this new law, some traffic police still file cases and impose fines, but BRTA is taking steps to resolve this issue quickly.

So, the only requirements for riding a motorcycle are wearing a helmet and being under the supervision of a licensed rider. No special motorcycle insurance coverage is required as long as you are legally riding on public roads and highways.

We hope today’s article was helpful. Please share your opinions in the comments section below.

Topics Covered: Is motorcycle insurance required? Why is it important? Physical coverage, non-physical coverage, Motorcycle Insurance Law 2022, and riding rules in Bangladesh.