Hero Launches Convenient EMI Scheme to Make Buying a Motorcycle Easier

3 mins read

3 mins read

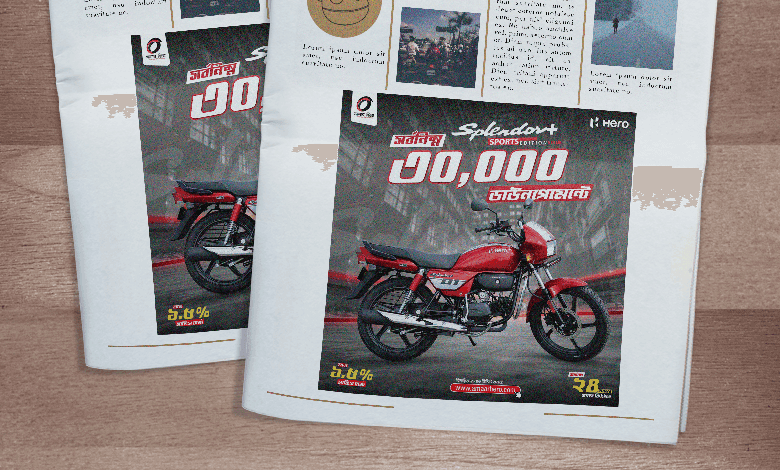

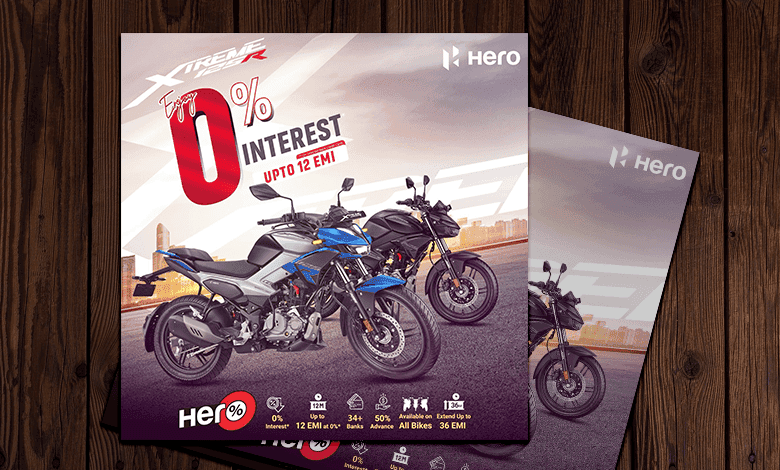

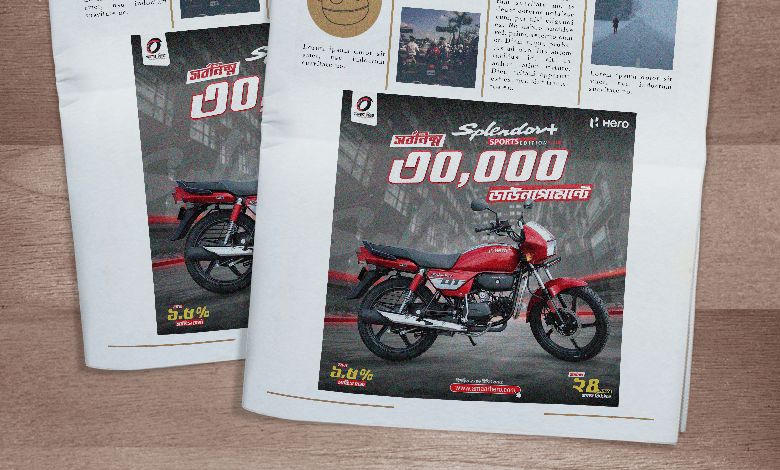

Owning a new motorcycle is now more accessible than ever, thanks to Hero MotoCorp Bangladesh's new easy installment purchase program. Designed for first-time buyers and budget-conscious riders, this initiative allows customers to buy their preferred Hero motorcycle with a simple 24-month EMI plan and a small down payment of just BDT 30,000.

The new offer aims to make motorcycle ownership more accessible in Bangladesh by tackling one of the biggest hurdles - high upfront costs. With living expenses on the rise and vehicle prices climbing, many riders postpone buying a new bike even though they need it for daily travel. Hero’s financing solution helps overcome this challenge by allowing customers to begin their riding journey with a more affordable initial payment.

The company explains that the EMI scheme provides straightforward, predictable monthly payments over 24 months, helping customers better manage their finances without feeling overwhelmed. With a low initial payment and a small monthly service fee of 1.5 percent, it stands out as one of the most affordable financing options in the local motorcycle market.

Hero has also highlighted that the scheme comes with low service charges and hassle-free processing, making installment purchases simpler. This approach is likely to resonate especially with young professionals, students, and daily commuters who depend on motorcycles for their daily travel but want flexible payment options.

Industry analysts observe that financing options are becoming more vital in Bangladesh’s motorcycle market. While features and design remain important, affordability and the simplicity of ownership now heavily influence purchasing decisions. Flexible EMI plans not only make it easier for customers to enter the market sooner but also encourage them to choose new motorcycles rather than used or reconditioned ones.

Hero motorcycles are well-loved in Bangladesh for their fuel efficiency, durability, and easy maintenance, making them a reliable choice for both city commutes and longer daily journeys. With the new EMI offer, owning one becomes even more affordable, especially for riders who want to keep long-term costs low.

The company presents this initiative as part of its broader effort to make reliable mobility more accessible to everyone. By reducing entry barriers with minimal down payments and affordable service charges, Hero hopes to reach a diverse range of customers across income levels.

Interested buyers are welcome to visit their nearest authorized Hero showroom, where friendly staff can help them explore eligible models, understand necessary documents, and discuss installment options. Sales representatives are happy to assist throughout the process and find a plan that fits their financial needs.

As motorcycle demand continues to rise across the country, initiatives like this easy EMI program demonstrate how manufacturers are adapting to market needs. With 24-month installment plans, a starting payment of BDT 30,000, and affordable service charges, Hero’s latest offer makes motorcycle ownership feel more attainable for many Bangladeshi riders.

The new offer aims to make motorcycle ownership more accessible in Bangladesh by tackling one of the biggest hurdles - high upfront costs. With living expenses on the rise and vehicle prices climbing, many riders postpone buying a new bike even though they need it for daily travel. Hero’s financing solution helps overcome this challenge by allowing customers to begin their riding journey with a more affordable initial payment.

The company explains that the EMI scheme provides straightforward, predictable monthly payments over 24 months, helping customers better manage their finances without feeling overwhelmed. With a low initial payment and a small monthly service fee of 1.5 percent, it stands out as one of the most affordable financing options in the local motorcycle market.

Hero has also highlighted that the scheme comes with low service charges and hassle-free processing, making installment purchases simpler. This approach is likely to resonate especially with young professionals, students, and daily commuters who depend on motorcycles for their daily travel but want flexible payment options.

Industry analysts observe that financing options are becoming more vital in Bangladesh’s motorcycle market. While features and design remain important, affordability and the simplicity of ownership now heavily influence purchasing decisions. Flexible EMI plans not only make it easier for customers to enter the market sooner but also encourage them to choose new motorcycles rather than used or reconditioned ones.

Hero motorcycles are well-loved in Bangladesh for their fuel efficiency, durability, and easy maintenance, making them a reliable choice for both city commutes and longer daily journeys. With the new EMI offer, owning one becomes even more affordable, especially for riders who want to keep long-term costs low.

The company presents this initiative as part of its broader effort to make reliable mobility more accessible to everyone. By reducing entry barriers with minimal down payments and affordable service charges, Hero hopes to reach a diverse range of customers across income levels.

Interested buyers are welcome to visit their nearest authorized Hero showroom, where friendly staff can help them explore eligible models, understand necessary documents, and discuss installment options. Sales representatives are happy to assist throughout the process and find a plan that fits their financial needs.

As motorcycle demand continues to rise across the country, initiatives like this easy EMI program demonstrate how manufacturers are adapting to market needs. With 24-month installment plans, a starting payment of BDT 30,000, and affordable service charges, Hero’s latest offer makes motorcycle ownership feel more attainable for many Bangladeshi riders.